- Eyewitness News 11PM10:00 AM GMT

- Eyewitness News 11PM10:30 AM GMT

- Eyewitness News 4AM11:00 AM GMT

- Eyewitness News 5AM12:00 PM GMT

168飞艇官网开奖结果数据+幸运飞行艇开奖历史记录查询 Live Channels

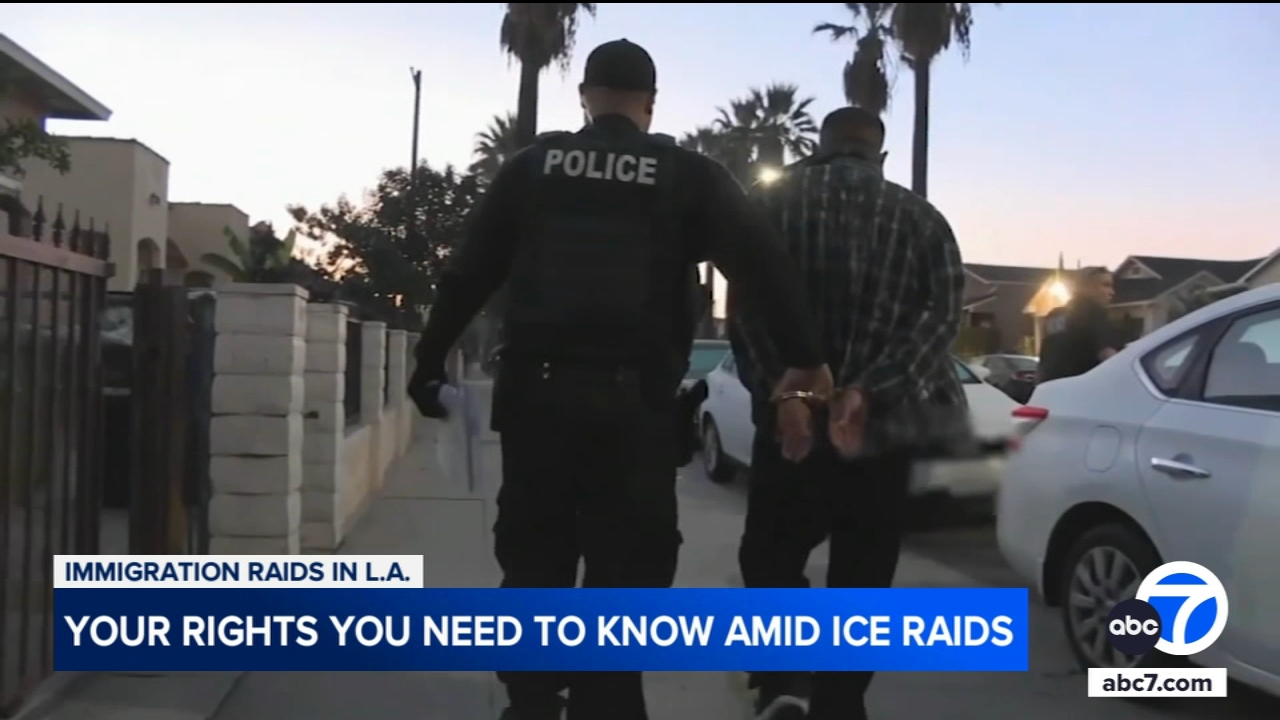

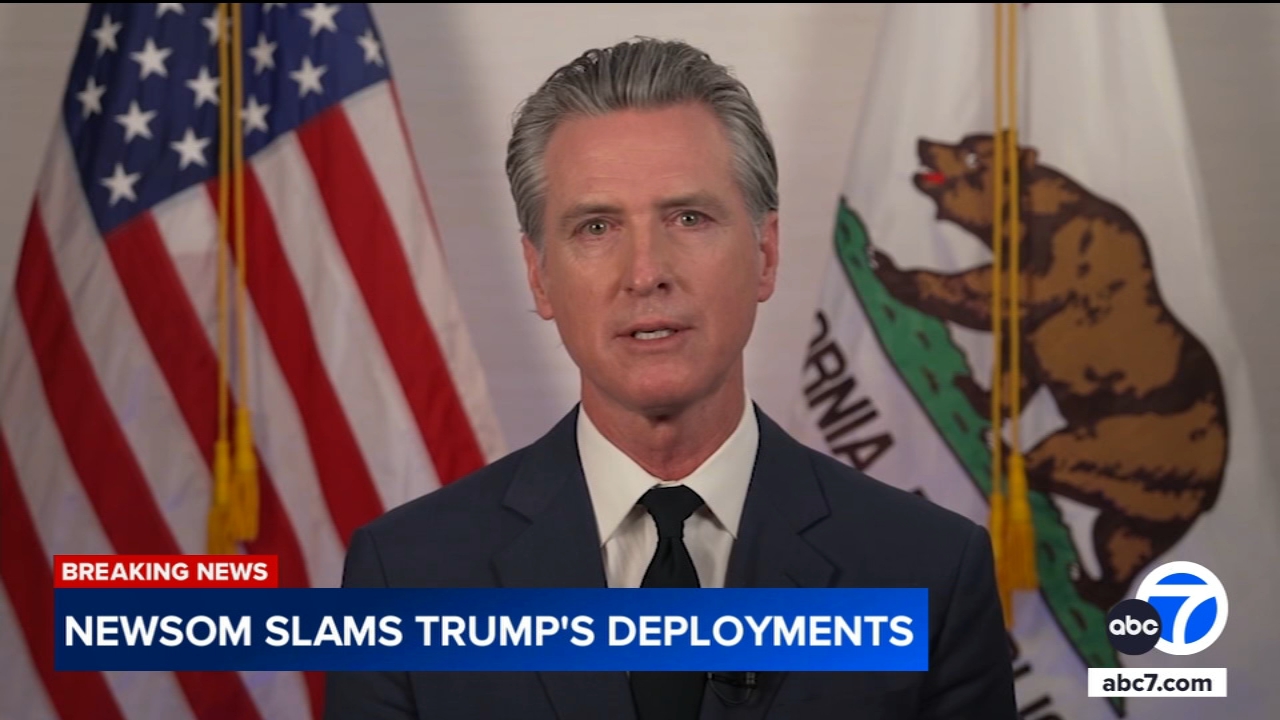

ABC7 Eyewitness News

Stream Southern California's News Leader and Original Shows 24/7

ABC News Live

Watch ABC News live news stream and get 24/7 latest, breaking news coverage, and live video.

On The Red Carpet Channel

Watch star-studded interviews from red carpet premieres, plus go behind the scenes of some of Hollywood's most popular movies and TV shows.

Car Chase Channel

A 24/7 channel documenting car chases across America. Previously recorded chases from across the country.

True Crime Channel

Uncover gripping real-life mysteries, shocking criminal cases, and the most riveting crime stories - 24/7. True crime, true consequences.

ABC News Live Los Angeles

Localish

We celebrate the good in America's communities: Good news. Good people. Good living.

Top Videos

By providing my email address, I agree to the Terms of Use and acknowledge that I have read the Privacy Policy.